Application Process

Application Process Timeline & Stages

Timeline Estimates

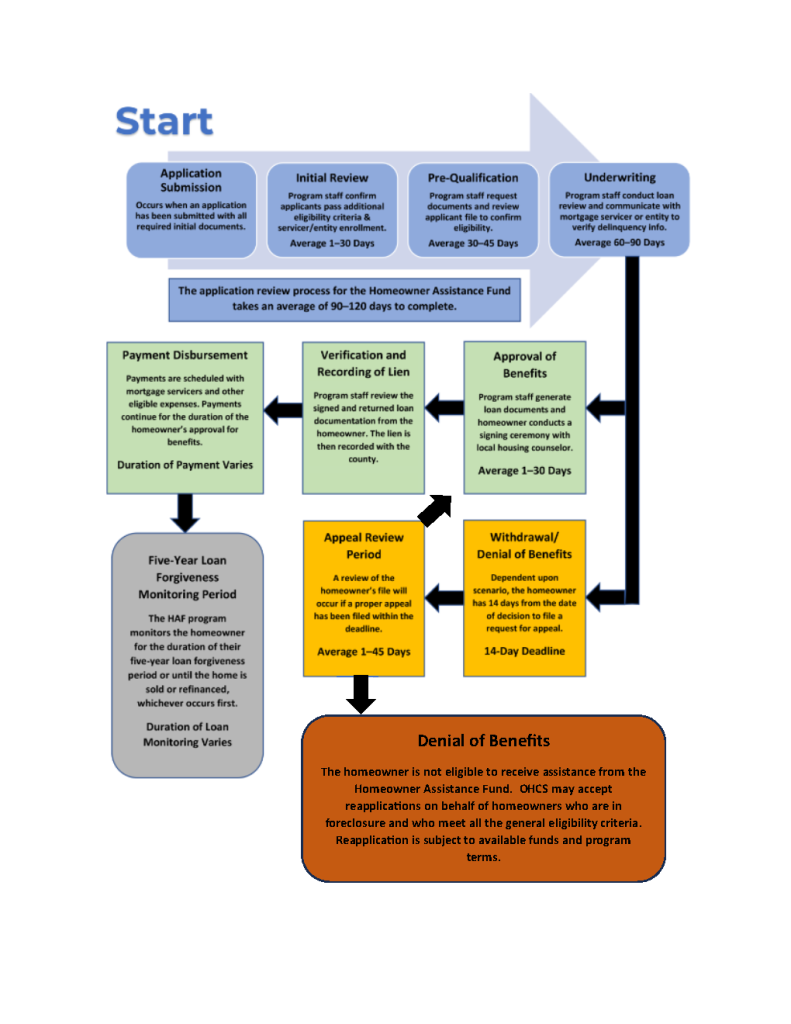

The following is an estimated timeline of the HAF application process:

- Oregon Housing and Community Services (OHCS) estimates it will take 90-120 days to process a HAF application if no additional documents are needed. You can speed up this process by uploading all applicable supporting documents with your initial HAF application, notifying OHCS in the application of the housing costs you want evaluated for payment (additional housing costs add time to review), and ensuring account and contact information is complete and accurate on your application and Third-Party Authorization (TPA).

- Note: As the program winds down, applications may be paused in stage four to assess whether there are still enough HAF funds to proceed with an application. Applicants in foreclosure will receive priority. Having an application submitted, preliminarily qualified, or in any later stage does not guarantee funding will be available.

- If approved, it can take another 30-60 days for a payment to be applied to your accounts: You must sign and return HAF loan documents to place a lien of “up to $60,000” on your property. HAF only schedules payments twice monthly, and mortgage servicers state it takes them up to two weeks to post a payment.

After the final payment, there is a five-year monitoring period before the HAF loan is forgiven. If you sell or refinance with cash out before full forgiveness, you’ll repay all or a portion of the HAF assistance. If you provide false information or do not provide information within timelines required by OHCS, your HAF loan will not be forgiven, and it’ll need to be repaid.

Understanding Application Stages

A HAF application may go through the following eight stages. Your online application portal will tell you what stage your application is in. You’ll also receive periodic emails when your application advances to a new stage or if a document request is initiated. We ask you not follow up on the status of your application unless you exceed the average timeline for any stage.

| Stage Identity | Description | Average Timeline |

| 1 – Registered | Applicant started an application for HAF, but the application has not been submitted. Please review the application for incomplete prequalification questions or required fields, missing documents, or missing hardship affidavits and disclosures (before submitting the application, you’ll need to send the DocuSign packet yourself). If you experience trouble, call customer support toll-free at 833-604-0879. Applications in Stage 1 will not be processed and will be inactivated after 14 days of inactivity. | Varies Until Submitted by Applicant |

| 2 – Submitted | Applicant has submitted a HAF application and initial required documents. At this stage, the application is reviewed to ensure it meets one of the Additional Eligibility Criteria. If a document request is initiated, please add 30 days to the expected timeline from the date of that request. | 0-30 Days |

| 3 – Qualification | Application is being reviewed for completeness to submit for underwriting. To receive all necessary items, additional documents may be requested of the applicant. If a document request is initiated, please add 30 days to the expected timeline from the date of that request. | 30-45 Days |

| 4 – Underwriting | Application is being reviewed by underwriters against all of the program’s eligibility requirements. If preliminarily qualified, HAF will communicate with your mortgage servicer and other housing cost providers to verify information in the application. This process is the Common Data File (CDF) record exchange, takes a substantial amount of time, and relates to letters that may appear on your application status. Once information is received from servicers, underwriters perform a final review. Additional documents may be requested of the applicant, and each request will add 30 days to the timeline. Note: As the program winds down, applications may be preliminarily qualified and then paused in stage four to assess whether there are enough HAF funds to proceed with an application. Applicants in foreclosure will receive priority. Having an application preliminarily qualified or in the CDF exchange does not guarantee funding will be available. | 60-120 Days |

| What is an I-record? What is a V-record? | An I-record is when OHCS initiates contact with the mortgage servicer or housing expense entity to confirm the homeowner’s information. A V-record is when the mortgage servicer or housing expense entity returns information to OHCS and “verifies” the homeowner’s information so OHCS can finish underwriting the file. Sometimes a V-record is incomplete, and a new record must be requested. If the servicer provides different information, OHCS will use that information to review the application. | |

| 5 – Closing | Application review is complete. The HAF team reviews the file and makes a final determination to approve or deny an applicant. If approved, HAF sends loan documentation to one of the OHCS HAF intake partners to coordinate signature and notarization, which must occur within 14 days after being sent. These loan documents are returned to OHCS to record as a lien for “up to $60,000” against your property or a security interest against your home. | 0-30 Days |

| 6 – Disbursement | Communication of approval goes out to servicers of eligible expenses, and payments are scheduled. Applicants will see disbursements scheduled on their dashboard. Once scheduled, HAF will group and make payments twice each month. Please note the date a disbursement starts in your dashboard is about one week before the payment is sent to your servicer. After that, servicers say it can take two more weeks to post the payment. Applicants receiving ongoing payments will forfeit their assistance unless they attest to occupancy and income requirements every calendar quarter (OHCS will email when quarterly verifications are needed). | Applicant remains in stage until fully funded, up to 12 months from first payment. |

| 7 – Monitoring | After the final assistance payment, applications are monitored during the five-year loan forgiveness period. The forgiveness period does not start until the last HAF payment is made on behalf of an applicant. | Up to five years after assistance |

| 8 – Completed | These applicants’ loans have been forgiven after the forgiveness period or have been repaid, in whole or in part, because the applicant refinanced or sold the property. Denied applicants are considered completed after any applicable appeal opportunity. | N/A Archived Data |

Application Withdrawals, Denials, and Appeals

Document Requests, Application Withdrawals, and Appeals

OHCS withdraws applications where the file is incomplete. To help applicants complete a file before withdrawal, OHCS will initiate a 14-day document request through the online application portal. A homeowner and their housing counselor will receive email notice of this online message and must log in to the portal to view the document request. A follow-up notice of this request is provided by email and/or phone to the homeowner several days later. If a homeowner does not upload the requested documents by the originally stated deadline, the application will be withdrawn.

An automatic 14-day appeal opportunity follows the same process as the original document request. A homeowner can only successfully appeal by submitting ALL of the requested documents. If an applicant does not upload all requested documents by the appeal deadline, the application will be closed and inactivated. Documents submitted outside of the online application portal will not be reviewed. If an application is withdrawn, a homeowner may only reapply once if they are in foreclosure or go into foreclosure after withdrawal. The reapplication will be subject to program terms and available funding.

Application Denials and Appeals

If a homeowner has supplied requested documents but still does not meet HAF program eligibility requirements, the application will be denied. Each denial decision is reviewed a second time. When an application is denied, an email is sent to the homeowner’s email stating the denial reason and whether that denial is appealable. Without limitation, the most common denial reasons for the HAF program are:

| Reason # | Description | Appealable? | |

| 1 | An applicant is in active bankruptcy, and the loan servicer, beneficiary, bankruptcy trustee, or court will not participate. | Yes | |

| 2 | The arrearage, or past-due amount, on your housing costs exceeds the program maximum benefit of $50,000. | No | |

| 3 | The investor who owns your mortgage refuses to participate in the program. | No | |

| 4 | The principal balance of your loan at the time of origination exceeded the conforming loan limits allowed under the program. | No | |

| 5 | An applicant isn’t identified as a borrower on the mortgage or an owner on the title. | Yes | |

| 6 | The applicant’s current first lien mortgage has no arrearage or there is no mortgage on the property, and there are no other housing costs that are past due (Past-Due Payment Relief program). | Yes | |

| 7 | The applicant’s current gross household income is more than 150% of the area median income, based on household size, for the Past-Due Payment Relief program. | Yes | |

| 8 | The applicant’s current gross household income is more than 100% of the area median income, based on household size, for the Ongoing Payment Relief program. | Yes | |

| 9 | The applicant’s hardship doesn’t meet the program requirements because it occurred before Jan. 21, 2020, and didn’t continue due to the coronavirus pandemic. | Yes | |

| 10 | The applicant’s hardship doesn’t meet the program requirements, because it was not related to the coronavirus pandemic. | Yes | |

| 11 | The applicant’s home is not an owner-occupied, single-family (one- to four-unit) primary residence in Oregon. | Yes | |

| 12 | The applicant’s home loan is an open home equity line of credit, which must be closed in order to participate in the program. | Yes | |

| 13 | The applicant’s monthly mortgage payment (principal, interest, tax, insurance, and association dues) is more than 43% of their monthly gross household income and they don’t qualify for the Ongoing Payment Assistance program. | Yes |